It is what is left over after a company has paid the direct costs incurred in making the.

#Revenue minus cogs download

If you want to learn how you can add more value to your organization, then click here to download the Know Your Economics Worksheet.Īccess your Strategic Pricing Model Execution Plan in SCFO Lab. Gross profit is sales minus cost of goods sold or cost of services.

#Revenue minus cogs how to

When you know how to calculate COGS, you will better manage your company’s financials or economics. Then calculate the Cost of Goods Sold as follows using the formula above: COGS are directly linked to the production or manufacturing of any finished product.

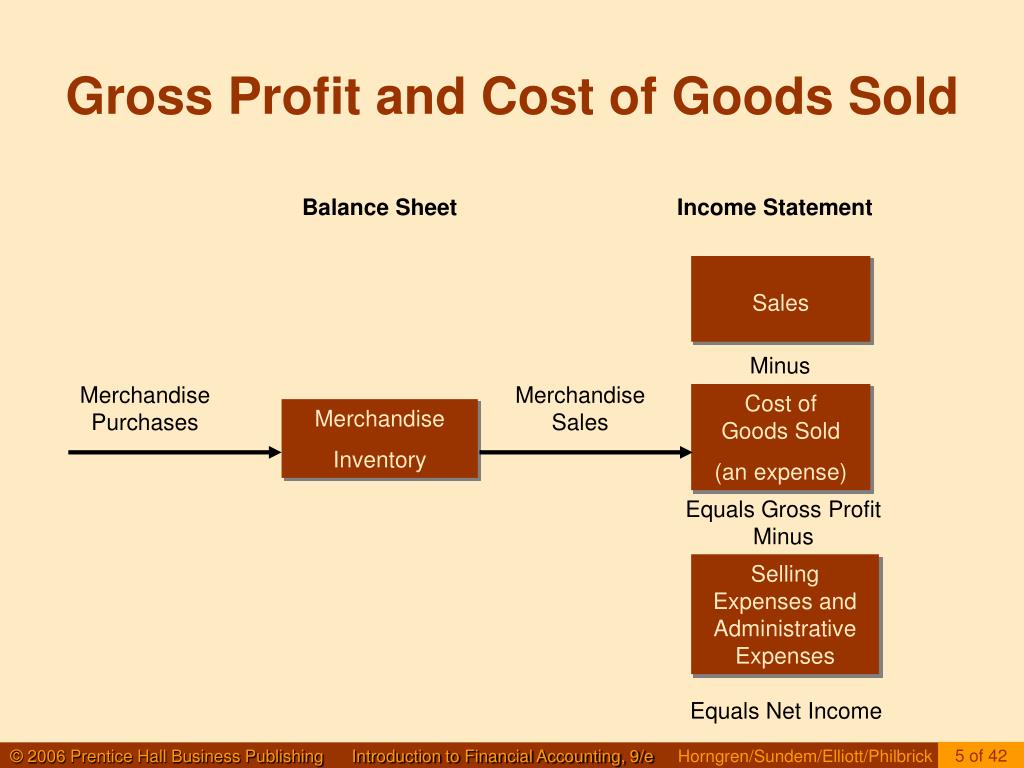

Gross revenue refers to the total goods and services rendered during the organization. Manufacturing or Purchase Costs = $120,000 The differences between cost of goods sold and expenses are given below: COGS refer to all the direct costs required in making the products or rendering services. Peggy an accountant is in charge of the inventory and Cost of Sales as it posts to the income statement. sells printers and other computer components to the the general public. This is the cost to produce the goods or services that a company sells. + Net Purchase (raw materials, labor, and overhead) Direct production costs are called cost of goods sold (COGS). Cost of goods sold is considered an expense in accounting and it can be found on a financial report called an income statement. Sales revenue minus cost of goods sold is a business’s gross profit. The formula or Cost of Goods sold equation is as follows: Cost of Goods Sold (COGS) is the cost of a product to a distributor, manufacturer or retailer. Or they may find a component of the Cost of Goods Sold expense to reduce. To calculate your net profit, you must first know what your gross profit is. The Gross Profit Margin percentage gives a company insight into what they need to charge for a certain product. Also, divide the Cost of Goods Sold by Sales to find Gross Profit Margin percentage. In fact, the Gross Margin is the result of Revenue minus the COGS. In addition, the Cost of Sales falls right underneath the Revenue or Sales on the Income Statement. Derive the COGS equation from the inventory which will be shown later.

Cost of Goods Sold ExplainedĬost of Goods Sold, explained as being an expense, has a direct correlation with the inventory which is considered an asset. Gross margin is calculated as total sales revenue minus its cost of goods sold (COGS), divided by total sales revenue and is expressed as a percentage. It is also referred to as the Cost of Sales, and the two are used interchangeably. Indirect Cost Cost of Goods Sold (COGS) DefinitionĬost of Goods Sold ( COGS), defined as the inventory expense that is sold to customers and is known as the largest expense to a company.

0 kommentar(er)

0 kommentar(er)